Your business most likely monitors its spending on advertising, production, and even your workspace – among other things. But you may not have a grasp on how much employee turnover is costing you – and even worse – it may be costing you more than you realize.

Do you know how much employee turnover costs your business each year? A business today with 50 employees can easily expect its annual turnover costs to exceed $160,000.00. This figure includes many of the unforeseen hard and soft costs that your business may be overlooking.

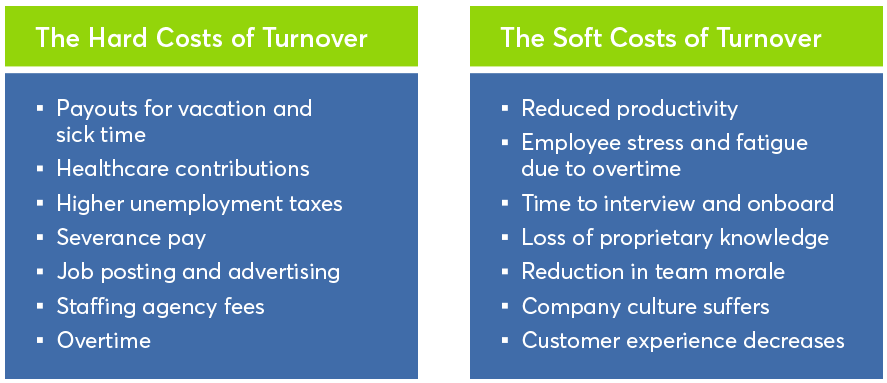

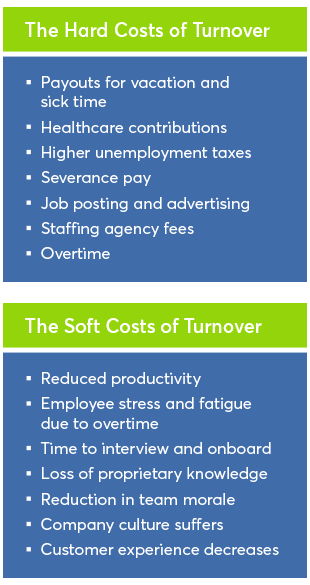

Let’s examine the hard and soft cots of employee turnover experienced in today’s business world:

Today, most companies keep track of employee turnover, although many fall short in understanding its causes and costs in an effective way. It can be very difficult to evaluate and reduce employee turnover for many businesses. High turnover trends are hurting businesses, not just in terms of money and time lost, but in decreased morale and productivity as well.

The Society for Human Research Management estimates that the cost of directly replacing an employee can run as high as 50-60% of their annual salary, and the total associated costs of turnover can rise to 90-200%. According the the Bureau of Labor Statistics, 3.6% of workers leave their place of employment each month.

A big takeaway for today’s business owners is simple… Satisfied employees don’t quit.

How do voluntary benefits lower turnover costs?

The most effective way to reduce your turnover rate is to provide a tailored employee benefits package. Tailored to fit the specific needs of your business goals and applications, and your valued employees. This includes affordable and reliable medical, dental, and vision – with voluntary benefits options – which are designed to supplement your employee’s medical coverage by putting cash into their pockets for unexpected injuries, illnesses and accidents.

The small costs associated with offering voluntary benefits are insignificant when weighed against the cost of losing a valued employee due to someone down the street having a better benefits package. Voluntary means these options are paid for by the employee, usually through payroll deduction with pre-tax dollars as an extra perk for the employee.

Tailored voluntary benefits options can include:

Offering voluntary benefits doesn’t have to cost the employer anything. It does, however, increase the chances of your employees getting the relevant insurance coverage that they want and need. That, in turn, helps your business retain its employees, and increases the likelihood that they’ll stay healthy and financially secure.

Employee benefits are no longer a one-size-fits-all option in today’s challenging business environment. Businesses today, that still provide a one-size-fits-all benefits package, struggle to retain and attract top-tier talent and maintain a higher employee satisfaction rate.

Tailored employee benefits may not be as expensive as you think.

Price is extraordinarily important when it comes to offering employee benefits. We provide full transparency throughout the insuring process. This means we will not furnish cherry-picked plans that offer higher commissions and/or bonus structures to our agents or agency. Your business will receive the lowest rates for the maximum coverage, with continued negotiation on today’s insurance programs from the leading carriers in the employee benefits insurance market.

Whether it is single-plan, multi-plan, a multi-tier plan approach, medical only, voluntary only, self-funded, ASO and anything in-between.

When you choose Averta Insurance Solutions to handle your employee benefits, you have selected an agency that has access to all of the leading carriers, yet has no allegiance to any single one.

Your savings is what matters to us most.

So… Are you tired of training your employees for their next job? Let Averta help you with that.

Click the graphic below to learn more about reducing your employee turnover.

You’ll be glad you did!